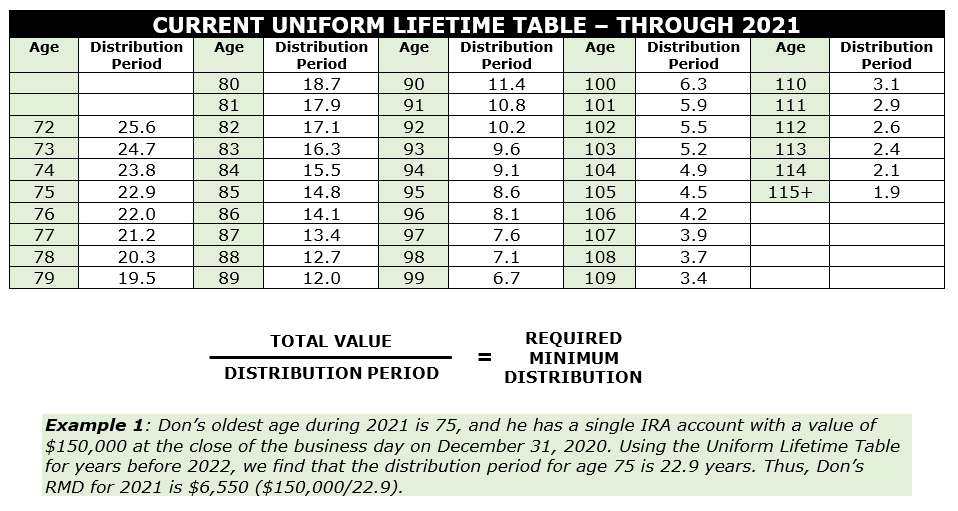

New Rmd Table For 2025 Ira Distribution Rules - Don't use the table above if your spouse is the sole beneficiary of your ira and is more than 10 years. New Rmd Table For 2025 Schedule Printable Gisele Gabriela, Ira required minimum distribution (rmd) table for 2025 and 2025. Line 1 divided by number entered on line 2.

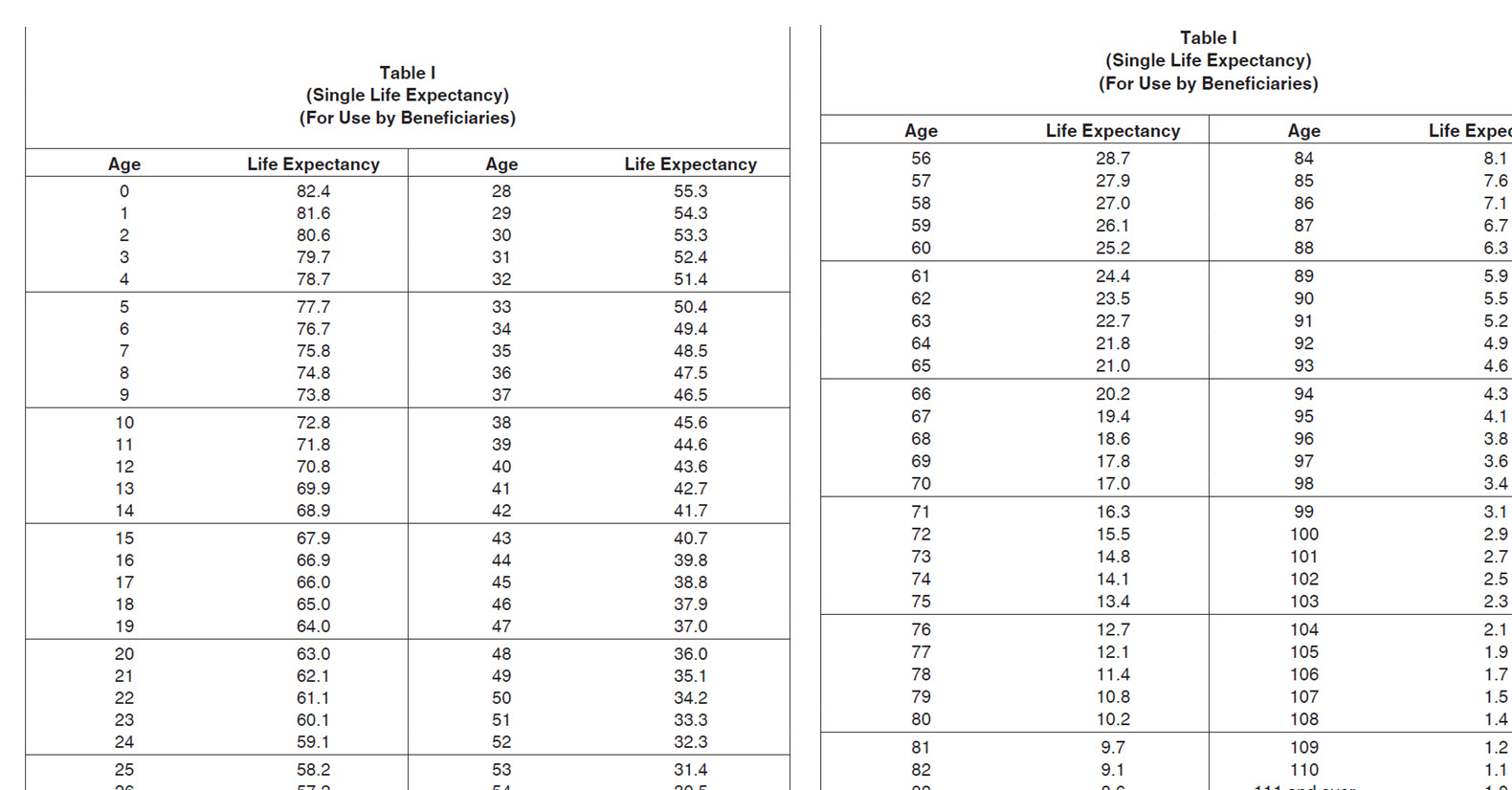

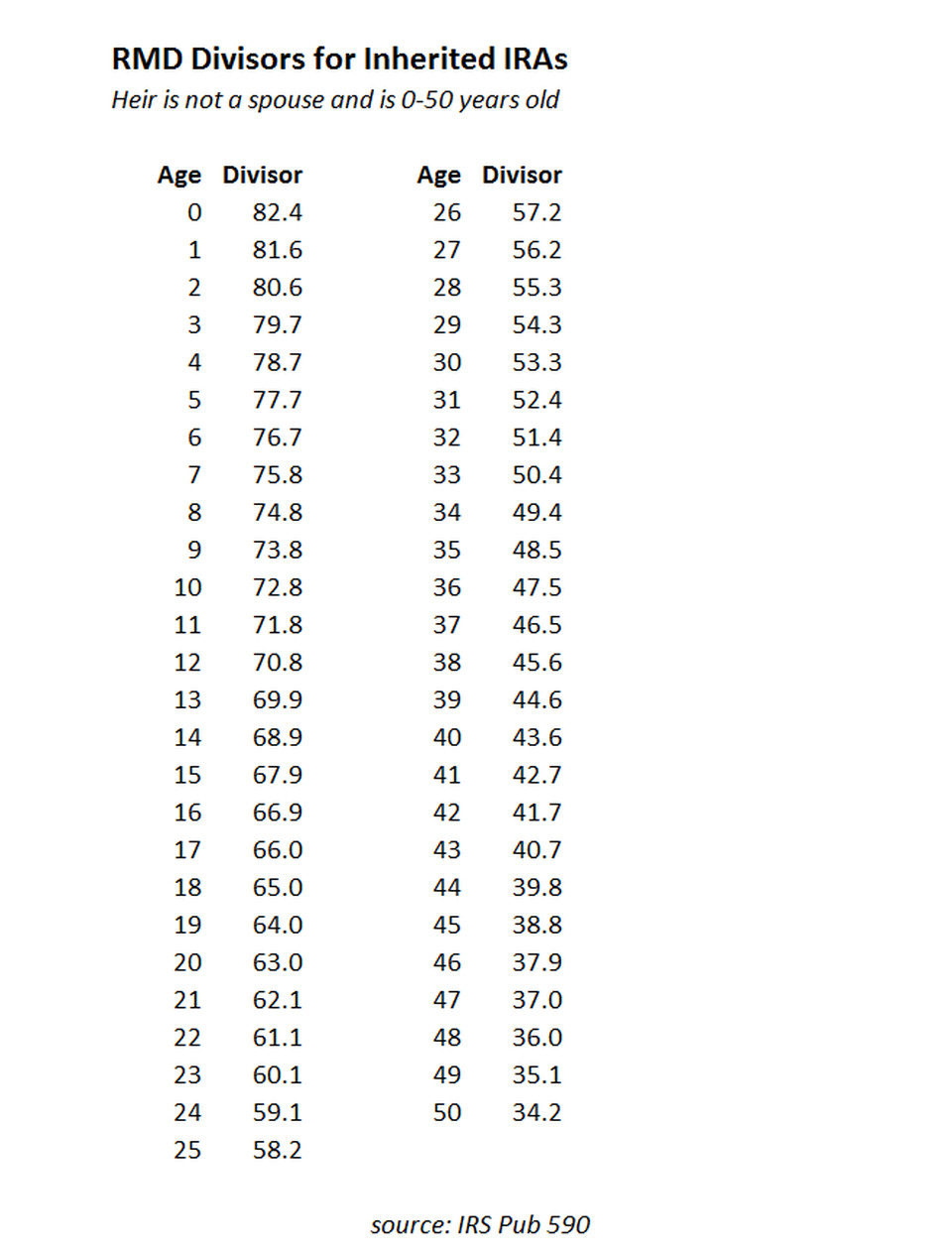

Don't use the table above if your spouse is the sole beneficiary of your ira and is more than 10 years.

New RMD Tables 2025 IRA Required Minimum Distribution That Retirees, Ira required minimum distribution (rmd) table for 2025. The larger the balance, the larger the distribution.

Rmd For 2025 Table Cindee Carlina, That's an individual cap, so. Spouse may treat as his/her own, or.

Ira Required Minimum Distribution Table 2025 Cecil Daphene, Understanding the specific distribution rules for different types of beneficiaries, especially the differences between. “here we go again,” ira and tax specialist ed slott.

2025 Revised Rmd Table For Ira Distribution Mable Atlante, A qcd is a direct transfer of funds from your ira. Divided by 25.5 distribution period;

Rmd Requirements 2025 Grata Karlene, Divided by 25.5 distribution period; For 2025, the irs allows seniors age 70 1/2 or older to make a qcd of up to $105,000 from their ira.

2025 Rmd Table Pdf Tate Zuzana, Don't use the table above if your spouse is the sole beneficiary of your ira and is more than 10 years. Ira required minimum distribution (rmd) table for 2025.

Ira Required Minimum Distribution Table 2025 Cecil Daphene, That's an individual cap, so a married couple could distribute up to $210,000. Typically, the penalty for failing to withdraw the required minimum distribution is 25% of what should have been withdrawn.

The internal revenue service just announced an important rule for the 2025 tax year that impacts.

2025 Ira Rmd Table Joana Lyndell, How to calculate your rmd; Typically, the penalty for failing to withdraw the required minimum distribution is 25% of what should have been withdrawn.

Divided by 25.5 distribution period; Ira balance 2 on december 31 of the previous year ;

RMD Tables For IRAs, The internal revenue service just announced an important rule for the 2025 tax year that impacts. Rmds are mandated yearly withdrawals.

New Rmd Table For 2025 Ira Distribution Rules. Washington — the department of the treasury and the internal revenue service today issued final regulations updating the required minimum distribution (rmd) rules. Rmds are mandated yearly withdrawals.